Netflix carried its newest quarter of unsatisfactory subscriber progress during the last three months of last year, an inclination that the organization predicts enduring into the new year as the rougher rivalry is weakening the video streaming front-runner.

The Los Gatos, California, firm added 8.3 million internationally subscribers during the October-December period, about 200,000 less than the organization had forecast. In addition, releasing its fourth-quarter consequences Thursday, Netflix also expected an upsurge of 2.5 million subscribers throughout the opening three months of this year, fine beneath predictors’ prospects for an improvement of 4 million, conferring to FactSet Research.

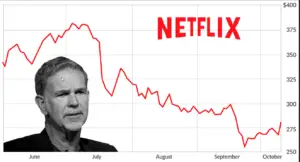

Netflix’s stock value drops Highlights

The unsatisfactory news produced Netflix’s stock value to drop by about 20% in prolonged interchange after the statistics came out, excavating a steep failure during the past two months.

It overlaid an exciting year for Netflix after it reveled in fulgurous improvements throughout the epidemic lockdowns of 2020 that drove homebound people to its service.

Netflix picked up 18.2 million international subscribers throughout 2021, its sluggish pace of yearly growth in five years. It came after Netflix increased more than 36 million subscribers during 2020. The service now vaunts nearly 222 million universal subscribers universal, more than other video streaming leaders.

But additional services assisted by deep-pocketed competitors such as Walt Disney Co. and Apple have been making inroads in current years, and a crowd of other networks also are splashing into video streaming in an effort to grasp eyeballs and a piece of household budgets. The intensifying rivalry is one reason Netflix definitely enlarge into video games last year.

- “The 2022 background for Netflix appears to have been set with a theme of rivalry thrive,” said Third Bridge analyst Joe McCormack.

- Despite the fact recognizing the competition is having an “on the edge” effect on its growth in its trimestral shareholder letter, Netflix highlighted its service is still flourishing in every country where it’s accessible.

- In a Thursday session call, Netflix managers also said hesitation caused by the ebb and flow of the epidemic during the past year has made it more problematic to measure forthcoming growth.

- COVID “has formed a lot of roughness,” co-CEO Ted Sarandos said. The firm’s other co-CEO, Reed Hastings, also uttered some prevention before addition, “For now, we are just like remaining quiet and trying to figure out.”

- In spite of the roughness, the firm is happening well monetarily, even nevertheless its income limitations are being embraced and cash is being exhausted by expenditure on more innovative programming to entice subscribers. Netflix earned $607 million, or $1.33 per share, in the fourth quarter, a 12% upsurge from the identical time in the preceding year. Fourth-quarter returns rose by 16% to $7.7 billion.

- Stockholders, however, are getting more apprehensive that Netflix may be approaching its topmost in acceptance. Those worries have triggered Netflix’s stock price to plunge by more than 40% from its peak of unevenly $700 reached in mid-November.

- The chances for upcoming development have developed mainly threatening in Netflix’s biggest market the U.S. and Canada where it’s preliminary to look as if most households concerned in subscribing to the service already have an account. Netflix ended 2021 with 75.2 million subscribers in the U.S. and Canada, translating into a paltry one-year gain of 1.3 million subscribers in that region.

Last week, Netflix raised up its worth by coarsely 10% within the U.S. and Canada a move that could reason some subscribers to abandon the service, based on the firm’s past antiquity with preceding value hikes.

On the positive aspect, Netflix on Friday will reveal the fourth season of “Ozark,” one of its utmost widespread series and a probable magnet for novel subscribers.