- The Metaverse Will Have A Significant Impact On Human Existence. Here Are Seven Firms That Might Benefit Significantly.

According to Jefferies analyst Simon Powell, the MetaverseMetaverse will be disruptive to society once it reaches its full potential during the next decade. However, numerous businesses may gain a lot from the new digital economy.

“A single metaverse may take a decade or more to emerge, but when it does. It has the potential to disrupt practically every aspect of human existence that hasn’t already been impacted,” Powell said in a long research paper titled “The Digitization of Everything,” released on Monday.

“The outbreak has accelerated the use of new technology.” “We will continue to move toward a digital world.”

Thanks to Facebook founder Mark Zuckerberg’s advocacy of the digital world’s potential, the word “metaverse” may have entered the general lexicon for the first time this year.

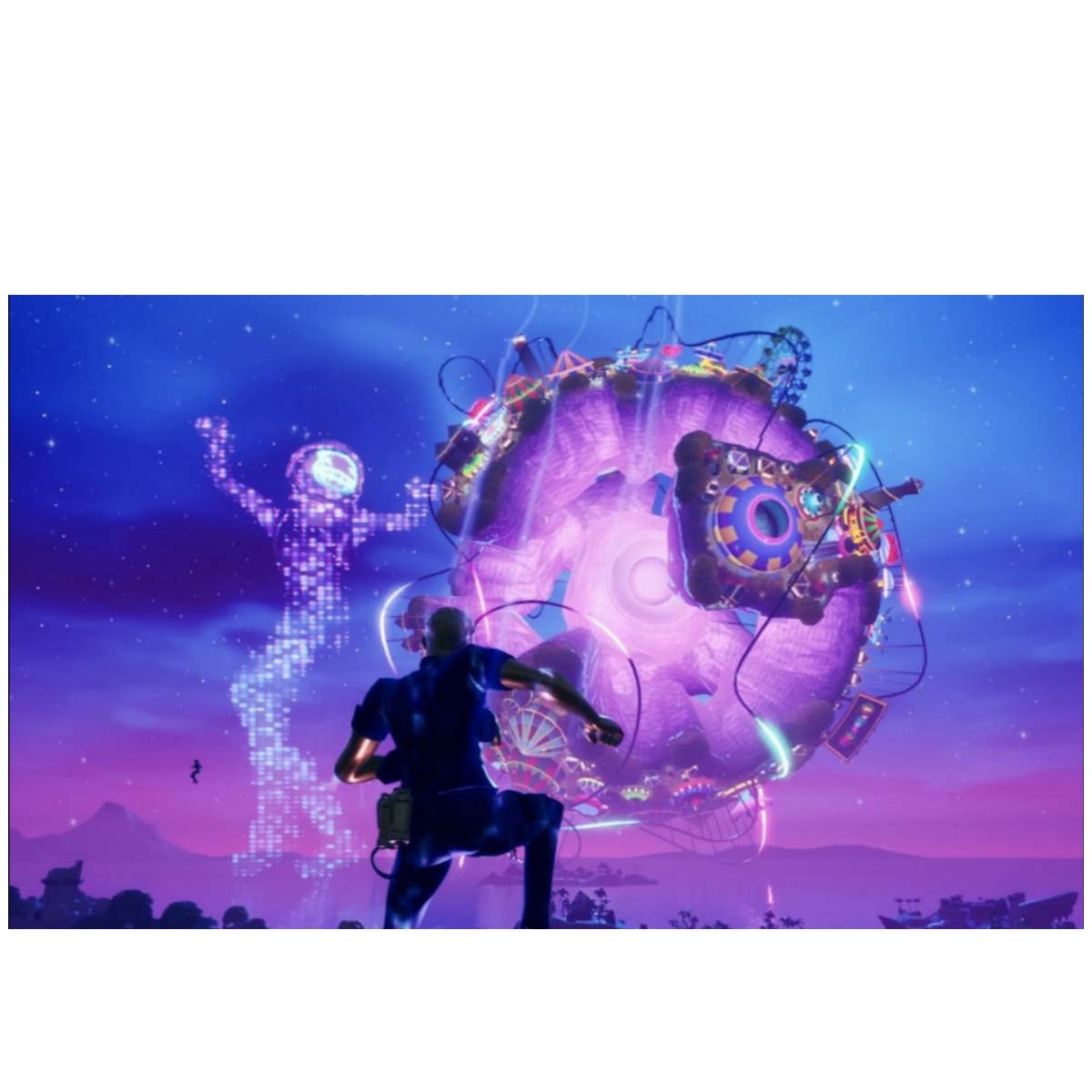

As this world takes shape, the way things are done will change dramatically. “Everything will be digitized,” Powell says, “resulting in a new universe that we can all enter and exit.

The Metaverse might be considered a new type of digital platform. In our perspective, it functions as a container for other digital media. When combined with other technologies and interfaces, it will not replace the internet, but rather build on top of it, allowing us to enter into and maybe live in it.”

This virtual world is predicted to alter how individuals interact with the actual world and collaborate.

I’m pretty enthusiastic about vision, “Drew Houston, the founder, and CEO of Dropbox said as much. “If you operate in that type of setting, or the MetaverseMetaverse, you need stuff, which is where Dropbox comes in. Dropbox may assist you with your digital content, which is what we are working on. It is extremely early in the morning. It’ll be a long voyage, but it’ll be thrilling.”

Powell of Jefferies concedes that it’s too early for investors to choose clear metaverse winners. Investors, on the other hand, may start devising a strategy.

“Concentrate first on the gear required to transform the internet into the MetaverseMetaverse. Then consider the software that will build and host it, as well as the businesses that will create use cases for it, “Powell continues. The analyst sees several potential metaverse winners, namely social media and gaming industries.

“While having massive social platforms, both Facebook (Meta) and Snap work on gadgets to access the Metaverse. Roblox (RBLX) comes the closest to becoming a metaverse in its early phases. Take-Two (TTWO) is currently working on three games that might be classified as early-stage metaverses. E.A. has several I.P.s that may be transformed into walled garden metaverses, including Skate, Sims, SimCity, and even its sports properties. With World of Warcraft in its portfolio, Activision Blizzard (ATVI) is one of the early metaverse pioneers.

In less than six months, Microsoft’s stock market valuation will reach $3 trillion:

According to Wedbush analyst Dan Ives, Microsoft, the newest Finance Company of the Year award winner, may not be done benefiting shareholders. “I think they obviously can hit,” the highly renowned tech expert stated when asked if Microsoft could reach a market valuation of $3 trillion in early 2022. Microsoft is rated Outperform by Ives, with a $345 12-month price target.

The stock of Microsoft is now trading at $322 per share. Microsoft is barely 23 percent away from achieving the $3 trillion market cap threshold, with a market value of $2.42 trillion. The corporation is just $2.7 trillion short of being the world’s most valuable company since Apple’s market valuation is $2.7 trillion.

“Microsoft is leading the way in the cloud, as we can see. That, I believe, is what we’ve seen with the stock a re-rating as investors better understand how this growth narrative is unfolding. This corporation, in our opinion, has a market capitalization of $3 trillion, “Ives went on to say.

First, despite increased volatility in big-cap tech equities, Microsoft’s stock has put in a solid 2021. Microsoft’s stock price has risen 45 percent year to far, considerably outperforming the S&P 500’s 21 percent gain. Meanwhile, Apple and Amazon, Microsoft’s main competitors, have only gained 21% and 5.5 percent, respectively, year to far.

Howley points out that its financials have been just as outstanding as its stock price success. Additional to Ives, Microsoft’s excellent momentum has drawn other bulls to the company.

“Even after one of the world’s most valuable companies (with a market capitalization of $2.5 trillion), we believe Microsoft has a bright future ahead of it. driven by continued growth prospects in large categories of I.T. spend (IaaS, cyber security, productivity, and so on), the ability to further monetize strong positioning in multiple end markets (via E3, E5, M365, and so on), and a financial profile that continues to exhibit stable growth and margin expansion (from 30% to 42%).”

With an Outperform rating and a $400 price target, the analyst commenced coverage of Microsoft.

The NASDAQ’s decline reminds investors of what happened in 2017:

The Nasdaq 100 Index’s recovery to start the week had done nothing to assuage investors’ anxieties following a selloff that has many fearing a repeat of December 2018, when a hawkish Federal Reserve sent markets plummeting.

The threat of increasing interest rates, sky-high valuations in technology companies, and mounting fear about an economic downturn, according to market observers, are all similarities to the selloff three years ago. The Nasdaq 100, which is heavily weighted in technology, dropped 12 percent in just two weeks and closed the year in negative territory for the first time since 2009, as rate rises prompted a selloff in high-priced equities.

Markets are set to reach a nail-biting conclusion in 2021, with Fed policymakers meeting next week. The Nasdaq Composite Index has dropped 5% from its top on Nov. 19, more than double the decrease in the broader S&P 500.

“The present market is eerily similar to the fourth quarter of 2018 when central banks throughout the world switched from easing to tightening,” Jim Dixon, senior equities sales trader at Mirabaud Securities, said.

Morgan Stanley and Bank of America Corp. stock market experts, who have also noted the similarities to 2018, indicate that markets recovered most of their December losses a month later. According to them, the current selloff might endure longer.

This is why: President Joe Biden, according to Morgan Stanley, appears to be more concerned with controlling inflation than with boosting the stock market, which was a regular topic of discussion under his predecessor, Donald Trump.

“We won’t see the same push on the Federal to ease off if marketplaces are continuing to waver as they did in late 2018 for the same reason a Fed determined to tighten policy,” analysts led by Mike Wilson said in a research note.

The most expensive equities in the technology sector led to the U.S. stock market’s decline last week. Crowd strike Holdings Inc., the Nasdaq 100’s most costly stock at 223 times expected earnings, and Zoom Video Communications Inc., at 42 times, have lost almost a quarter of their value since the high.

On the other hand, it is trading at all-time highs, despite a relative value at less than 29 times earnings. The iPhone manufacturer is seen as a safe investment in uncertain times. Depending on previous performance and relative valuations, analysts such as Brad Reback of Group inc. Financial Corp. warned of the possibility of further falls in a grouping of bellwether software companies such as Salesforce.com Inc. “Growth equities are more costly now than they were in previous eras,” he added, “suggesting that downside risk remains.”

For the time being, the Nasdaq 100 is sure to rise again on Tuesday, according to strategists at Barclays Plc and UBS Global Wealth Management. They believe that a more hawkish Fed and the spread of the omicron version of the coronavirus would not derail the stock market surge.

“Markets are in for a rocky ride this month,” Nicholas Colas, co-founder of DataTrek Research, said. “When we’ve already had outstanding returns and investors confront both Fed policy and near-term earnings uncertainty, history is simply too unambiguous about how December goes.”

The buzzword “metaverse” has lost its luster with the latest selloff. The Roundhill Ball Metaverse ETF, which holds stocks such as Roblox Corp., Nvidia Corp., a graphic processing maker, and Facebook owner Meta Platform Inc., has given up all of its gains since Facebook changed its name to Meta.

The Amazon Web Services outage is impacting businesses around the United States:

The latest proof of how specialized the business of keeping the internet running was coming on Tuesday when a major outage in Amazon’s cloud computing network disrupted service at a wide range of U.S. companies for more than five hours.

The Amazon Web Services outage mainly affected the east coast of the United States. Nonetheless, it wreaked havoc on everything from airline reservations and auto dealerships to payment apps and video streaming services, as well as Amazon’s massive e-commerce operation. For much of the day, the Associated Press’ publishing system was down, significantly limiting its capacity to post news reports.

Amazon has not yet revealed what went wrong. It limited Amazon’s Tuesday communications to detailed information on an AWS center console and a brief statement delivered via a spokesperson. Richard Rocha acknowledged that the outage had impacted Amazon’s storage facility and shipping operation but said the company was “trying to fix the issue as soon as possible.”

Around five hours after various organizations and other groups began reporting problems, the company claimed that it had “mitigated” the fundamental problem that caused the outage, which it did not describe, in a posting on the AWS status page. It took many hours for some affected firms to review their systems and restart their services thoroughly.

Andy, who took over from founder Jeff Bezos in July, was the previous CEO of AWS. Amazon’s cloud-services division is a significant earnings generator. Synergy Research has a larger share of the $152 billion cloud services market than its closest competitors, Microsoft and Google combined.

The AWS outage, according to Carl Malamud, a technologist and public data access activist highlights how Big Tech has perverted the internet, which was designed as a distributed and decentralized network to endure global calamities like nuclear war.

“When we put everything in one place, whether it’s Amazon’s cloud or Facebook’s monolith,” said Malamud, who founded the internet’s first radio station and later put a robust U.S. Securities and Exchange Commission database online. “We saw that happen when Facebook became the vehicle for a massive disinformation campaign, and we’re seeing it happen again today with Amazon’s failure.”

Single-point failures appear to rise, resulting in broad and frequently lengthy outages. In June, the behind-the-scenes material distributor became live. Many major internet sites, including CNN, The New York Times, and the United Kingdom government’s main page, were unavailable for a brief period.

Then, in October, Facebook, now known as Meta Platforms — blamed an “erroneous configuration modification” for an hours-long global outage that also affected Instagram and WhatsApp.

According to Doug Madory, director of internet monitoring at Kentik Inc, a network intelligence organization, issues started mid-morning on the U.S. East Coast this time. One of the more well-known names affected was Netflix, which saw a 26 percent drop in traffic, according to Kentik.

Customers attempting to book or change flights with Delta Air Lines could not do so. Delta representative Morgan Durrant said, “Delta is working fast to restore functionality to our AWS-supported phone lines.” According to the company, customers should instead utilize the airline’s website or mobile app.

After the outage disrupted specific airport-based systems, Dallas-based Southwest Airlines claimed it shifted to West Coast servers. Customers were still reporting them to Down Detector, a prominent clearinghouse for user outage complaints more than three hours after the disruptions began. Flights were not disrupted much, according to Southwest spokesperson Brian Parrish.

According to Toyota spokesman Scott Vazin, the U.S. East Region’s dealer services have decreased. Inventory data, calculators, service bulletins, and other stuff are all accessible through the company’s applications. There were over 20 applications that it impacted.

Also Read: Last Week, Cryptocurrencies Had Net Inflows But Outflows On Friday – Coin Shares