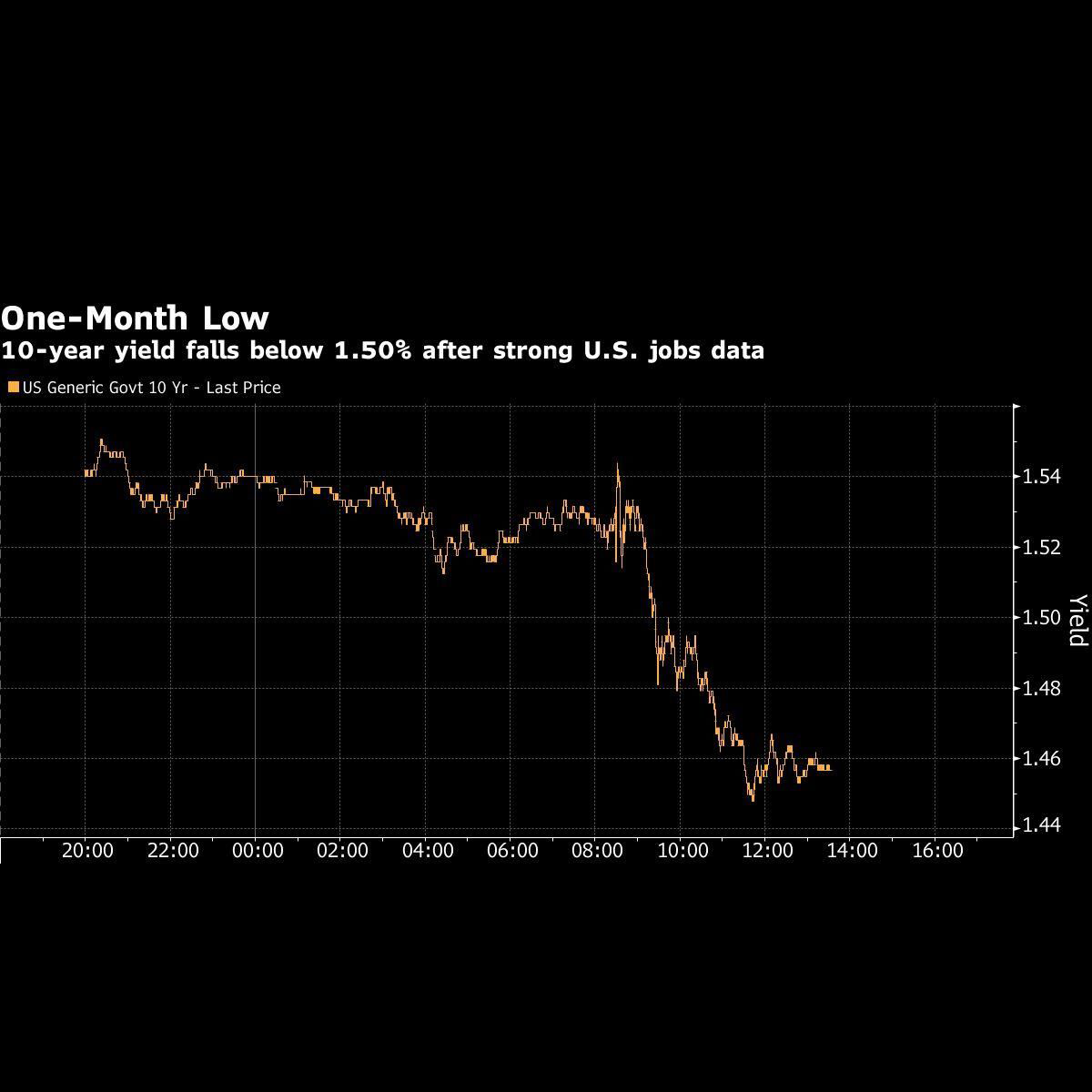

In a little more than a year, putting the market on a good pace for its overall highest two-day advance, Despite the amazing employment data, Treasuries still surged.

There was a decline faced by the United Kingdom government in the yield of bonds for the second day straight. This decline was global as in the period of extension; the investors put a price of maximum lowest rates of the central bank.

The ten years of treasury yield fell by 7.8 basis points to the 1.45 percentage point. For the very first time since September, This fall was recorded as the 50 to 200-day average. It has fallen by 14 base points in the past few days, and this was the biggest decline since the month of June 2020. The United Kingdom’s ten-year yield has declined by 23 base points by the same amount of time.

Praveen Korapaty, who is the head of interest-rate strategy at Goldman Sachs & Co, said, “The report itself set up a stronger foundation for the higher yields,” referring to the October data of employment which showed the exact payroll growth exceeding the expectations. It was then revised higher for the month of September. “But there is a wider environment of markets who are thinking again how aggressive central banks may get in this matter of the inflation given the outcome of Bank of England meeting yesterday.”

The United States two year yield also declined by 3.8 base points on Friday afternoon after the drop of 4.1 base points on a day before, that is, Thursday. The two-year yield of the United Kingdom saw a decline of 30 base points since the widespread expectations by the bank of England that it would raise rates were was defined.

As it is expected, the data of the jobs comes after the United States Federal Reserve, which is two days. It is said that the tapering of asset purchases will begin this month which would be raising of interest rates precursor. The taper conclusion can take place by the mid of the next year, 2022, at this announced pace. However, this pace is not fixed; it is most likely to change because of the economic conditions, which include the employment recovery taking it to the pre-pandemic level.

The job creations of 531,000 against the median forecast of 450,000 in October seems to be a good number till now but not strong enough to generate the Fed’s taper causing rate hike – timeline said John Briggs, who is a global head of desk strategy at NatWest Markets.

After the decision of the Bank of England on Thursday, Fed rates increased U.S. short-term market-priced interest rates later. Right now, the prices show a first-time rate increase in September, and a second one will happen by February 2023. Earlier, two increases were said and priced in for the year 2022, the first being in the month of July.

Alex Li, who is the head of U.S. rates strategy at Credit Agricole, said that the yield curve flattening is consistent with Fridays.

“The timing of a liftoff is being pushed off a bit,” which is putting pressure on short-term yields, while “lower longer end rates are consistent with growth getting slowed down” as fiscal and financial support are withdrawn, Li mentioned.

The treasuries gains are somewhat motivated by the short coverings which contributed to the rally led by the United Kingdom on Thursday. CME Group Inc’s preliminary data of open inter for the future of treasury seems like it will be declining steeply, especially in this two-year contract. 2.3 percentage point decline is seen in two-year note future on open interest. This is the largest drop seen this now for the past three weeks.

The inflation being too high was emphasized by Fed officials even as their hope to recover the foster labor market by keeping the rate of interest low.

Esther George, who is the president of the Federal Reserve Bank of Kansas City, said on Friday, “the risk of an elongated period of rising inflation has increased,” and “the argument for patience is in the face of these inflation pressures have almost diminished.”

The fall of almost about 8.4 base points to the 1.88 percentage point and the decline in the -10 and -30 years of yield was the lowest recorded since Sept 23rd. Despite the next week’s auctions of the tenors, this came. On Nov 3rd, the auctions sizes were announced. These sizes are smaller than the ones announced previous to the newly issued auction in the month of august

however, the decline was the first recorded since the year 2016.

This auction of ten years was cut from forty-one billion dollars to thirty-nine billion dollars, and the auction of 30 years was cut from twenty-seven billion dollars to 25 billion dollars.

(Adds of market-implied expectations for the Fed policy are in the 8th paragraph, strategist comments are in the 10th paragraph.)

Most Read from the Bloomberg this Business week

- All Those 23andMe Spit Tests Were Part of a somewhat Bigger Plan

- Papa John Is Still very Obsessed With Papa John’s

- The Power Grid Is Just Another Casino for Energy Traders Now

- The Amazon Is Fastly Approaching a Point of No Returns

- Big Teacher Is Watching: How A.I. Spyware Took Over Schools

Also Read: Currencies Firm After the U.S. Occupations Information; Real Brazilian Leads