- Satya Nadella, Elon Musk, and Jeff Bezos received special honors for global entrepreneurship from TiE. The company is based in Silicon Valley. The Indus Entrepreneurs (TiE) have named Kumar Mangalam Birla, Chairman of the Aditya Birla Group, the Global Entrepreneur of the Year in Business Transformation. According to the organization, Birla is the first Indian industrialist to get this honor.

An impartial panel led by Tim Draper, Founder of Draper University and Venture Capitalist, chose the honorees. “It is an honor to accept this distinguished award in a year defined by such extraordinary change,” Kumar Mangalam Birla, Chairman of the Aditya Birla Group, said.

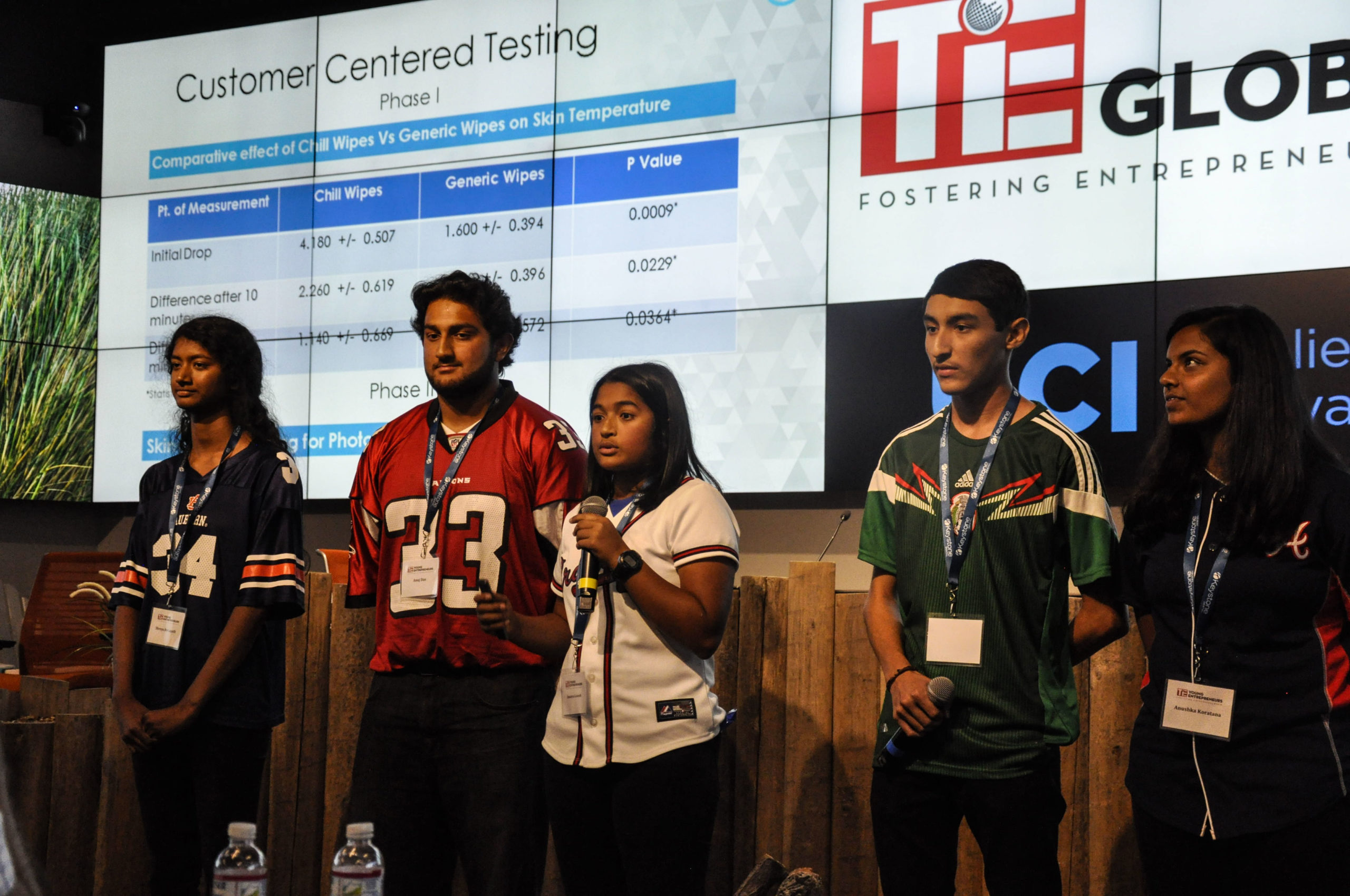

Birla also praised TiE for fostering entrepreneurship with a “special style of nurturing, coaching, and networking.”

“These awards are aimed to celebrate the facilitators of the global ecosystem,” stated Praveen Tailam, Chair of the TiE Global Board of Trustees. These are the folks who are enabling our next generation of enablers by giving chances for wealth development, job creation, and inspiration.” Policymakers, corporate tycoons, and entrepreneurs gathered in Dubai for the two-day TiE Global Summit awards ceremony.

Under hawkish BoE decisions and guidance, the pound/euro might rise over 1.19: Analyst:

The British Pound has been slowly rising recently, indicating that markets are gradually strengthening expectations for a Bank of England rate rise today. Failure to hike rates might therefore see some of these recent gains reversed. However, expert estimates suggest that a pressing need for higher rates due to rising inflation could keep losses small.

According to the OIS market, the odds of a December rise plummeted to roughly 30% on December 09, a financial futures contract market that provides the most precise available indicator of market interest rate expectations.

In late November, it was as high as 90-100 percent. However, two days of better-than-expected news from the UK economy has brought estimates back up to just above 50%. According to Pantheon Macroeconomics, market expectations for a hike began to rise after Tuesday’s labor market data indicated there was no increase in unemployment following the government’s Covid jobs assistance scheme’s termination in September.

However, November inflation data reawakened markets to the need for a rate hike: inflation is already at 5.1 percent year-on-year and is expected to exceed 6.0 percent in the coming months.

“Markets pushed February back to being fully priced for a 25bp rise after yesterday’s high inflation statistics for November. But we believe the danger of core inflation de-anchoring will lead to the symbolic hike today,” says Peter Chatwell, Head of Multi-Asset Strategy at Mizuho Bank.

The Bank of England is responsible for managing inflation under 2.0 percent, and markets believe that arguing for emergency record-low rates in a context of soaring inflation is just impossible. The Pound to Euro exchange rate hit a low of 1.1638 on December 09 but has since rebounded to 1.1736 as rate hike forecasts have risen somewhat.

Despite an enormous increase in the US Dollar, the Pound to Dollar exchange rate has remained steady, hovering around 1.32-1.3250. “GBP/USD might rise to $1.35 by the end of the week if the central bank decides to boost rates, while GBP/EUR could be on the verge of a new 2021 high. On the other hand, any inactivity is likely to be brief, limiting the adverse risk for sterling as a result of this event, “Western Union Business Solutions’ Currency Strategist, George Vessey, agrees.

Pound Sterling Live offers a lot of FX and strategy data to comb through, all of which predicts how the Pound will respond to the Bank’s numerous decisions on Thursday. However, the degree to which the market anticipated a rate hike in the run-up to the announcement would ultimately determine short-term price action: the surprise element always wins out.

As a result, any short-term tactical research prepared based on a different set of market assumptions/information/expectations quickly becomes obsolete if market odds improve in the 24-48 hours leading up to the decision. Once the chances for a rise reach fully-priced levels, the Bank must meet expectations and rise for the currency to sustain any gains earned in the run-up to the decision.

Decision Guide: Norway Is Set for a Rate Hike That Isn’t Done Deal: Norway Is Set for a Rate Hike That Isn’t Done Deal:

Even if fresh coronavirus limitations have suddenly made the decision much more delicately balanced, Norway’s central bank will likely raise interest rates on Thursday. According to a Bloomberg poll, all but one analyst believes the Norges Bank will adhere to its plan to hike the benchmark deposit rate by 25 basis points to 0.5 percent.

Consumption rebound and unprecedented support from Norway’s $1.4 trillion sovereign wealth fund have helped its economy grow faster than expected, outpacing most of its wealthy counterparts. As energy-driven inflation reaches its highest pace in 13 years, job openings are breaking records, and salary expectations are growing.

As a result of this environment, Norges Bank has become one of the most hawkish central banks among powerful nations, having already hiked rates once in September. With the European Central Bank remaining in stimulus mode and an early rate rise by the Bank of England no longer considered inevitable, Thursday’s decisions might accentuate that situation.

Even if Norges Bank raises interest rates on Thursday, and support for the Norwegian krone “is likely to be short-lived,” according to analysts at Danske Bank. This quarter, the krone has been the second-weakest among the G-10 currencies.

Bets for a rate rise in Norway have returned this week, despite traders seeing little chance of a hike. Forward-rate agreements with a three-month maturity in March are now trading at 0.92 percent. They decide on a rate of 0.75 percent, which is the Norwegian interbank offered rate.

While inflation is a problem, the impact on living expenditures from Europe’s rising energy prices is also a factor against a rise in Norway. That may be less of a concern now that the government has committed more than 8 billion kroner ($890 million) in subsidies and tax cuts to assist people to cope with rising power prices.

The most significant environmental shift has resulted from omicron-related actions, such as a ban on alcohol sales in restaurants and bars that went into effect on Monday. According to Bloomberg’s Covid Resilience Ranking, this will impact consumer services in an economy that has been one of the most robust to the virus in the last year.

Even if authorities decide not to raise rates this week, Swedbank, the lone forecaster anticipating the rise to be postponed, believes the Central Bank will still have a favorable view for the economy and boost the rate path in the future.

In a letter to investors, Swedbank analysts Kjetil Martinsen, Marlene Skjellet Granerud, and Jon Espen Riiser wrote, “Regardless of the December ruling, the longer-end of the route should be revised up.”

Also Read: Entrepreneurs Need Funds To Complete The Lease By The End Of The Year