Peloton Interactive Inc on monitor throughout the IPO (initial public offering) of the business firm, opposite to the Nasdaq MarketSite in New York, USA, on Thursday, September 26, 2019. The signboard is displayed.

Share Peloton It locked at $ 24.22, down 23.9% on Thursday, clearance the market capitalization of about $ 2.5 billion.

Due to the high-pitched decline, shares clear-fell underneath the $ 29 at first priced in September 2019, marking additional noteworthy momentous in the firm’s chaos in current months.

Stocks that jumped later according to the CNBC reports that an associated fitness firm has provisionally on hold manufacture of its products and was halted several times due to instability.

Peloton, run by CEO John Foley launched over two years ago, it had an opening market capitalization of $ 8.1 billion.

The stock was momentarily traded underneath the $ 29 threshold after its public entrance. Around mid-March 2020, Peloton stocks persisted around $ 23 as the wider market fell in the hesitation of the COVID-19 close to the start of the pandemic.

Though, stock values have increased suddenly as stockholders have started to see Peloton as the decisive stay-at-home order. On 14th January, last year, Peloton’s share price success a daytime high of $ 171.09. Reported three-digit earnings progress. We also witness record low levels of agitating among users. At that point, it had a market capitalization of approximately $ 50 billion.

However, Peloton’s huge progress, attached with source chain restrictions, has started to increase stockholder worries little by little. A buyer who capitalised thousands of dollars on a bicycle or one of Peloton’s treadmill machines informed a postponement in delivery. Enforced to capitalise to upsurge manufacturing measurements.

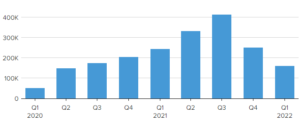

So, Bulletin of a child who pass away in an accident Last March, astonished both stockholders and clients in linking with Peloton’s more luxurious Tread + treadmill machines. At first, Peloton counterattacked the phone for the firm to memory the treadmill machine. Nevertheless, due to extra injuries testified Peloton publicised a voluntary assortment of both Tread and Tread + products last May. At this particular opinion, the stock was interchanged for less than $ 100. For better understanding, we will provide the graph below.

In current months, Peloton has been sluggish to cultivate profits, accumulating fewer novel users every quarter than it did a year ago. Some of this was expectable as the pandemic urged an unexpected consumer demand for Peloton’s fitness products when the gym was provisionally shut down and people wanted to work out at home. But nowadays clients are speaking about tones, hydro, mirror, Tempo and Clmbr, to designate a few. You can also reappear to your gym or boutique fitness class.

After reportage three successive quarters of net income Peloton posted a loss during the three months finished 31st March and its losses have enlarged trimestral since then.

- Peloton states that up until the fiscal year 2023, we cannot suppose make a revenue before interest, taxes, depreciation, and amortization.

- As per the report of CNBC on Tuesday: Peloton is presently working with referring firm McKinsey & Co. Look for chances to diminish costs, such as redundancies or store closings.

- At the close of this month Work on delivery and arrangement fees for bikes and tread products, partially due to historic price rises. Prices for that bike range from $ 1,495 to $ 1,745. Its cheap treadmill will rise from $ 2,495 to $ 2,845. Bike + remains at $ 2,495, according to the Peloton website.

- Peloton just cut the value of its bike by about 20% last August to $ 1,495. Said it desired to provide consumers additional reasonable choices.

- Andrew Boone, a specialist at JMP Securities, supposed in a note to customers that the forthcoming price upsurge could make an additional $ 150 million in revenue and gross profit in 2023. This is unpretentious by the price increase and can be considered a more sensible option.

- Though, supplementary charges can upset requests and drive customers to shop somewhere else.

Peloton is dedicated to the invention and innovation of products towards international level expansion to drive upcoming progress. We will start retailing strength products quickly Peloton Guide $ 495 for a heart rate armband and bundle. We assume remaining users to be repeating firearms when buying accessories and gear such as Peloton dumbbells and cycling shoes.

After increasing more than 440% in 2020, Peloton’s share price fell down almost 76% in 2021. Peloton’s market value drops $ 2.5 billion when stocks fall below IPO prices