Since the increase in policy changes is happening in the taxes along with the other rapid increase of the economic sectors, it is most likely that the Small Caps Lead Forward in Profit and the investors will soon hear the good news of some gains.

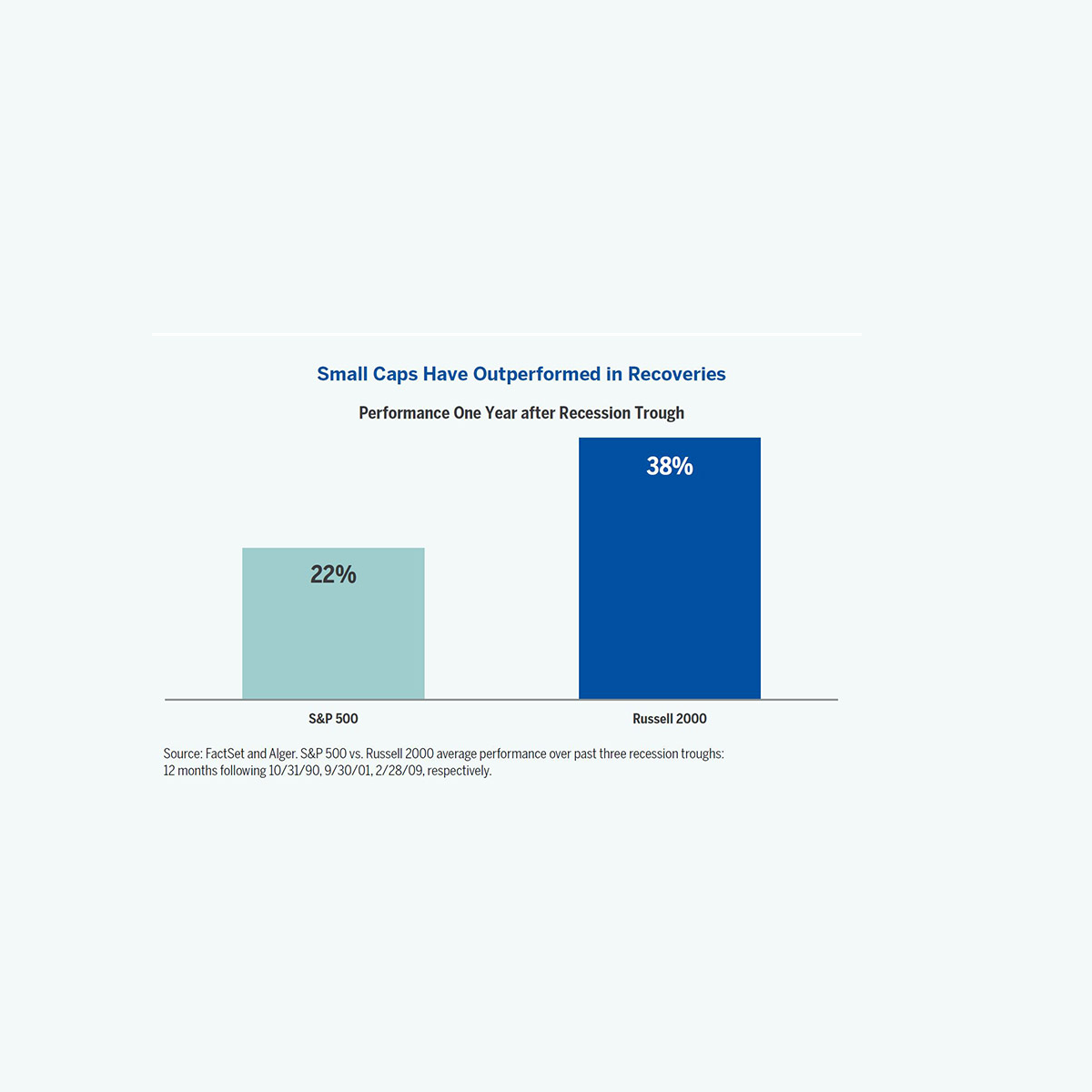

About a seven percentage points increase was noted for the small-cap index of the Russell 2000. Similarly, a double gain was seen for the large-cap of S&P 500. This was because, at the beginning of this week, a small-cap index of S&P 600 gain of about eight percentage points occurred. EPFR or Emerging Portfolio Fund Research, Inc reported that since the beginning of March, the biggest profit was noted by the small-cap funds, which were about two point four billion dollars.

S&P 500 gained about twenty-five percentage points, and in its competition, a nineteen percentage points rise was noted by the Russell 2000 recently. It is being said that Russell might even gain higher than the S&P 500. Even in the middle of the fourth wave with a delta variant of COVID 19, the stocks related to tech rose to peak seeing huge profits even though previously they were not performing well in the market.

Because of the restarting of the economic sectors and industries, it was foreseen that the firms with a low market capitalization of about one point two billion dollars would see gains. In the 2021 beginning, major improvements in the small business caps were seen.

Boda Global Research mentioned that on the basis of the sales prices and the booking prices, the discounts are provided by the small caps, and this method is also used by the Russell 2000 small-cap. The average difference of about twenty-four percentage points is seen recently in the Russell 2000 large-cap and the Rusell 2000 small-cap, and this is due to the classical reason of discounts mentioned above.

The Jacob Asset Management’s officer for the investments named Ryan Jacob stated that more of the attraction is found in the small caps than the overall larger caps and the reason for this is because they seem more efficient with an apparently more organized environment.

He further said that the larger cap shares are at a much lower weightage of the stocks funds than the smaller caps right now as they are at their peak right now, and it is the highest of what they have ever seen.

Onto Innovation which is a semiconductor firm, and Matson, which is a shipping company, both have added shares along with the small-cap exposures in the Horizon Investment Services firm. Chief executive officer CEO of this firm Chuck Clarkson said that this was added in the previous four months duration.

Investors looking for ways to diversify the mega-cap technology are Improving the picture for small companies. This is a source of great relief by all the investors of this firm.

Also Read: MediaTek Eyes Premium Android Phone Market With New 5G Chip