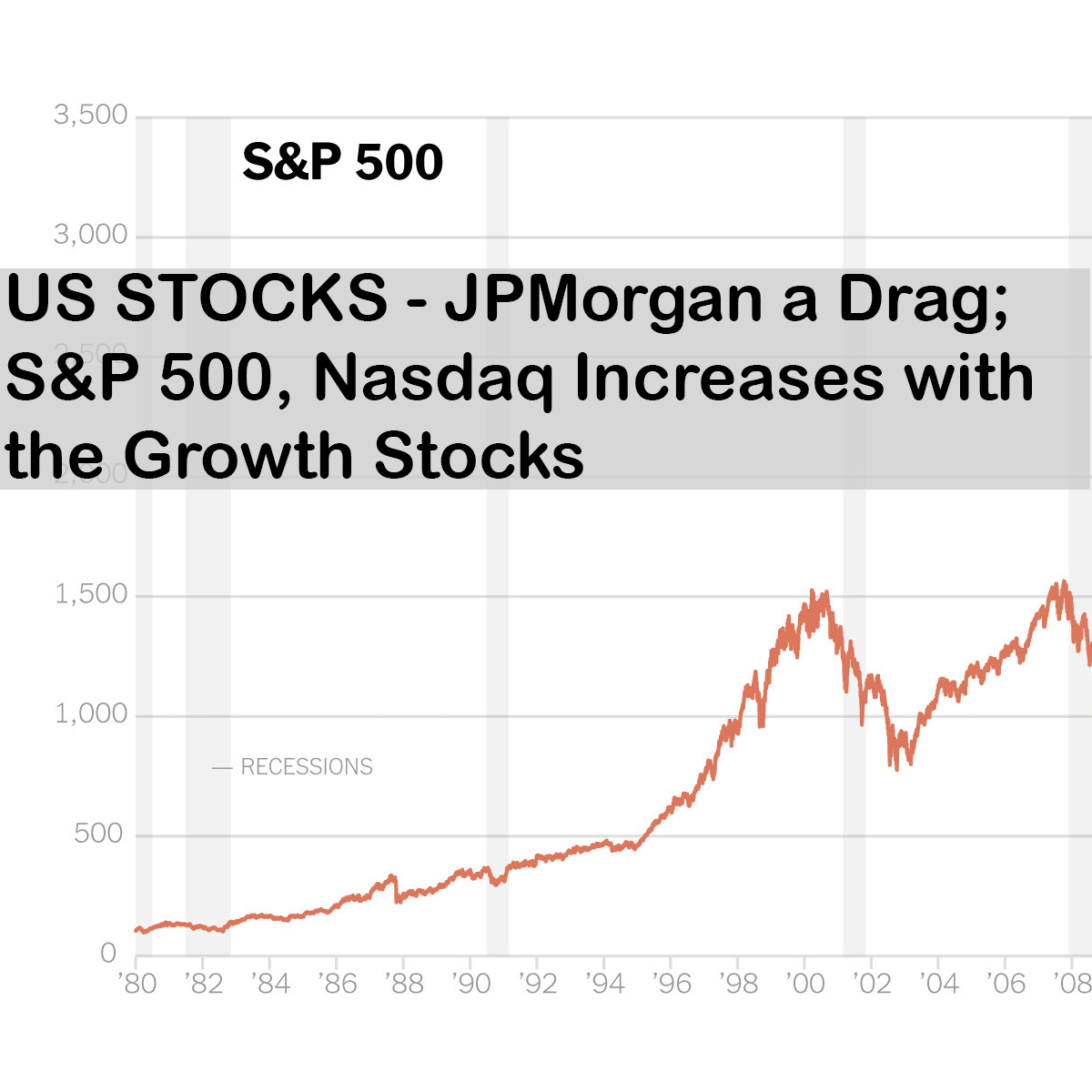

On Wednesday, the S&P 500 and Nasdaq finished higher by gains in portions of large development names such as Microsoft and Amazon. The shares for JPMorgan fell down with bank shares.

The S&P 500 states that the arrival of minutes added to gains from the month of September in a Federal Reserve strategy meeting.

U.S. national investors flagged they could begin lessening emergency period support for the economy in mid-November; however, they stayed separated over the amount of a threat of high inflation and how soon they might have to raise loan costs, the minutes showed.

Prior, a Labor Department report showed purchaser costs expanded unequivocally in September, further reinforcing the case for a Fed loan fee climb.

Portions of JPMorgan Chase and Co fell 2.6% despite the fact that JPMorgan’s second from last quarter profit beat assumptions, helped by worldwide dealmaking blast and arrival of more credit misfortune saves. The stock fell with a big drag for S&P and Dow that ended with a flat curve alongside the other bank shares that left a bigger drag for the market.

With longer-dated Treasury yields down on the day, the S&P 500 bank list declined by 1.3%.

The day’s corporate results got going second from last quarter benefit for S&P 500 associations.

Jim Awad, senior managing chief at Clearstead Advisors LLC, said that “My expectation is that as we deal with income season, that the forward-looking direction will be adequate that we’ll close the year higher. Yet, in the present moment, the market is in a show-me stage.”

Mega-caps covers development names including Google-parent Alphabet, Amazon.com Inc, and Microsoft Corp all rose.

A ratio of 0.53 points fall was observed for Dow Jones Industrial Average to 34,377.81, the Nasdaq Composite added 105.71 points to their 14.571.64, and the S&P 500 gained 13.15 points to 4,363.8.

BlackRock Inc acquired 3.8% after the world’s biggest cash manager beat quarterly benefit gauges as a further developing economy helped support its resources under management, driving up charge pay.

Additionally, in income, Delta Air Lines fell 5.8% after the organization detailed its first quarterly benefit without government help since the Covid pandemic, however, it cautioned of a pre-charge misfortune for the final quarter because of a sharp ascent in fuel costs.

Apple Inc plunged 0.4% after stats revealed that the company was intending to cut production for the iPhone 13.

Other issues dwarfed outnumbered NYSE by a 1.73-to-1 proportion; it was a 1.39-to-1 for Nasdaq proportion supported advancers.

A new record was posted by S&P 500 with new 52-week highs in the 8 records and 9 new lows. There were about 47 new highs and 56 new lows for the Nasdaq Composite.

The key points to highlight from this week are.

- From November Fed minutes hint at tapering

- BlackRock gains after earnings, JPMorgan falls

- S. consumer prices rose up in September

- Indexes: S&P 500 up 0.3%, Dow Jones flat, Nasdaq up 0.7%

Also Read: ARK Invest’s Wood – Warns about upcoming economic downturn in China ‘obvious.’