A lot of questions are asked, and a lot of fingers are being pointed at the personal financial interest of the Fed. This is because of the two senior officials who recently resigned after the reputational crisis.

In September 2021, the financial fallout response of the Fed after the Covid pandemic is because of the two heads Dallas Fed President Robert Kaplan and Boston Fed President Eric Rosengren, of the 12 reserve banks of the Fed. Highlights of the large transaction made were seen.

At first, they both did not agree to resign, but after the public fallout, they had to step down and retire early.

“Why do the FOMC policy settlers profit from the trades? They already have a lot of power.” These questions are being asked repeatedly, and their ethical practice is in question.

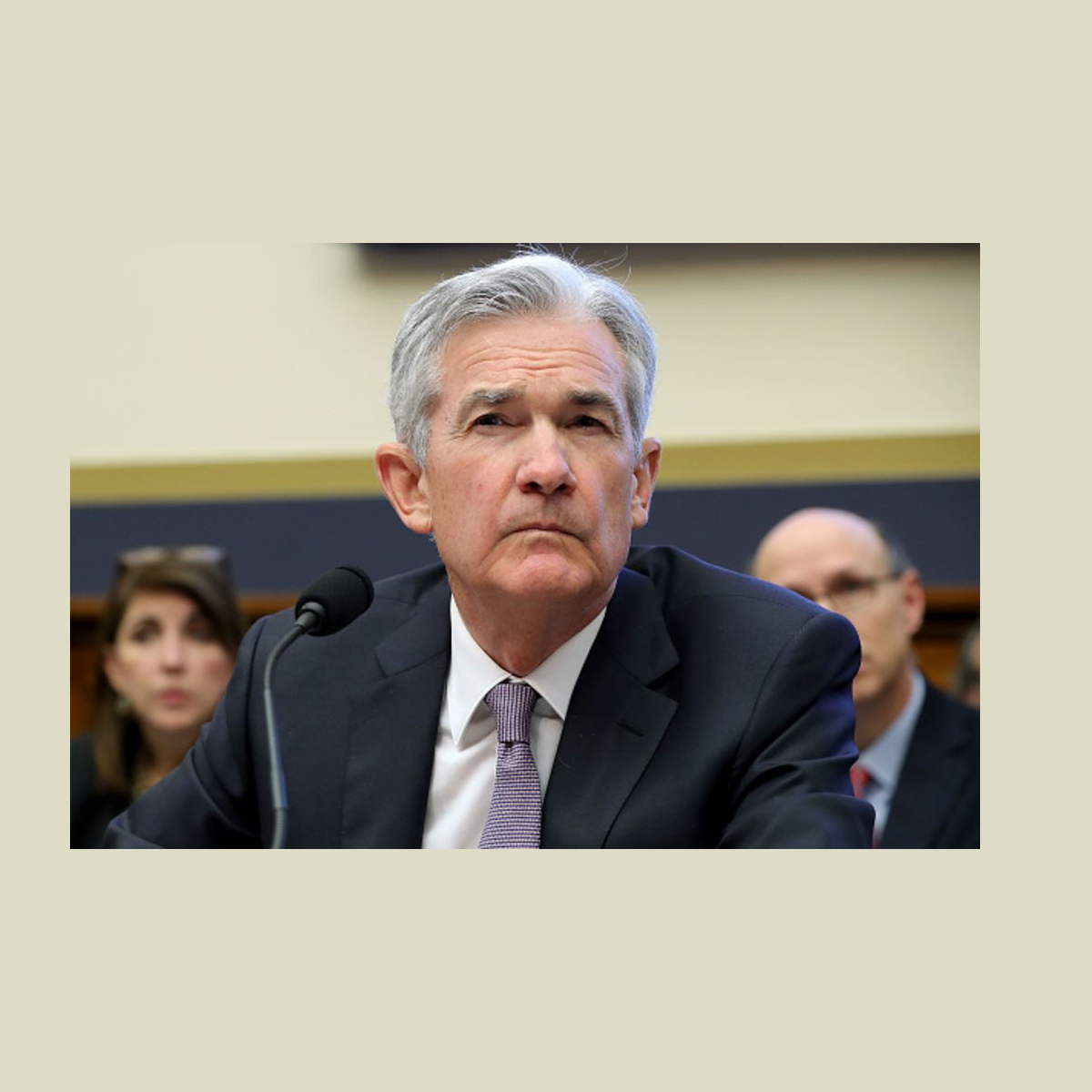

“No one is happy about this,” on September 22, Powell talked to the press. “No one in the FOMC is happy to be in this uncertain situation or to be having these questions raised. It is something that we take seriously.”

For the Fed, the whole situation seems like a “calamity and a scandal,” according to the professor at the University of Pennsylvania known as Peter Conti-Brown.

“I think the central bankers should never have to be under any suspicion as they are advocating for policies that will benefit them,” Conti-Brown said.

On September 29, Mary Daly, who is the San Francisco President, said that Fed ethic rules are not enough.

September 7, 2021

Kaplan took stakes in Delta Air Lines, Apple, Occidental Petroleum, and iShares Floating Rate Bonds ETFs with more than one million dollars. Kaplan made this trade of stocks back in 2020, as the Wall Street Journal reported.

September 8, 2021:

The trades were surely made abiding by the ethic rules, said the Boston Fed. In 2020, Bloomberg reported that purchases were made in securities and ERITS by the Rosengren because of which contagion warning publically was done to him.

September 9, 2021:

On September 30, a promise was made that the presidents would let go of their holdings and would be actively participating in it.

September 15, 2021:

Senior officials to be banned from trading and having stocks will be imposed in the next sixty days. Sen Elizabeth Warren wrote about this to all the Federal reserve banks.

September 16, 2021:

A detailed and fresh check of the ethic rules was made by all the Fed senior officials, and there seemed to be no problem. All the rules were very strict and even stricter than the rules of Congress itself.

September 22, 2021:

No one seemed to be happy about the strict restrictions set by Powell on the Feds officials about the trade and policy. Up until the President filed the annual disclosures, Powell had no clue about anything he mentioned in an interview.

September 27, 2021:

Boston President of Fed, Eric Rosengren, announced to retire on September 30, 2021, even though he had to retire in June 2022. He did so because of his underlying kidney issues.

On October 8, 2021, Dallas Fed President Robert Kaplan decided to step down too. This is after the markets will close down and because of the risk of his finances.

September 28, 2021:

Fed is making sure that the trading was done in supervision and in accordance with the rules and laws, strictly. This was according to Powell when Congress asked him questions.

A spokesperson of the Securities and Exchange Commission told the interviewers that this definitely “does not guarantee the existence or the nonexistence of an investigation.”

September 30, 2021:

Approved by the fed reserve board, a new replacement will be appointed by a panel of Boston Fed board directors. The new replacement would be permanent as Rosengren retired from the Boston Fed’s post of President. The new interim vice president would be Kenneth Montgomery.

October 1, 2021:

The transaction of one million dollars and five million dollars from the Pimco fund to the stocks was a representation of an already planned idea of rebalancing, said a Fed spokesman. This trade was made by Richard Clarida, who is the Fed Vice Chairman. This happened on February 27, 2020. Powell, before this day on February 26, issued a statement saying to reiterate the economic support f the Fed.

For the determination of a violation of the laws of trading, Warren asked himself to investigate the trades thoroughly.

For making sure that the trades were according to the rules and ethics, there will be a review check by the Office of Inspector General of the central bank. This was mentioned by a Fed spokesperson.

October 8, 2021:

A committee will be selecting the new Dallas Fed President as Kaplan retires, who will later be approved by the Fed board. Vice president

Meredith Black would be serving as interim for the time being.

October 12, 2021:

“I have always carried myself honorably, with integrity and respect for the obligation of public service.” Said Clarida as she talked about the 2020 transaction indirectly during an international finance event.

October 18, 2021:

The fund is a broad market index, unlike the trade that was done by Rosengren. Powell selling the shares from the stock market total index fund was highlighted in The American Prospect in October 2020.

October 27, 2021:

For making the ethical rules and trading by individual stocks, a new bill would be passed by the four Democratic senators. These rules are almost similar to the ones announced by the Fed in Oct 2021.

November 3, 2021:

members of Congress and administration officials were briefed by the Powell, and now he awaits the feedback to make improvements, but he declined to tell whether Joe Biden was briefed too or not.

Also Read: Microsoft Appoints Dohmke as the CEO of GitHub, a Code-Sharing Platform