LONDON (Reuters) – During the last month, the business in Europe remained still at peak with its demand and supply, but that raised an inflationary pressure that struck the demands for the supply for restricted activities, that are most likely to continue with the issues according to reports on Tuesday.

Numerous limitations forced to contain the Covid pandemic have now been lifted in the district; firms are experiencing deficiencies of staff, crude materials, and transport.

Governments are feeling the tightness to resuscitate their sickly economies to battle the more irresistible Delta variation of the virus and keep away from additional lockdowns this colder time of year.

The EMA’s decision comes after the EU’s irresistible sicknesses place cautioned last week the area’s inclusion of immunizations was still excessively low, and there was a danger of a huge flood in cases, hospitalizations, and passings over the course of the following month and a half.

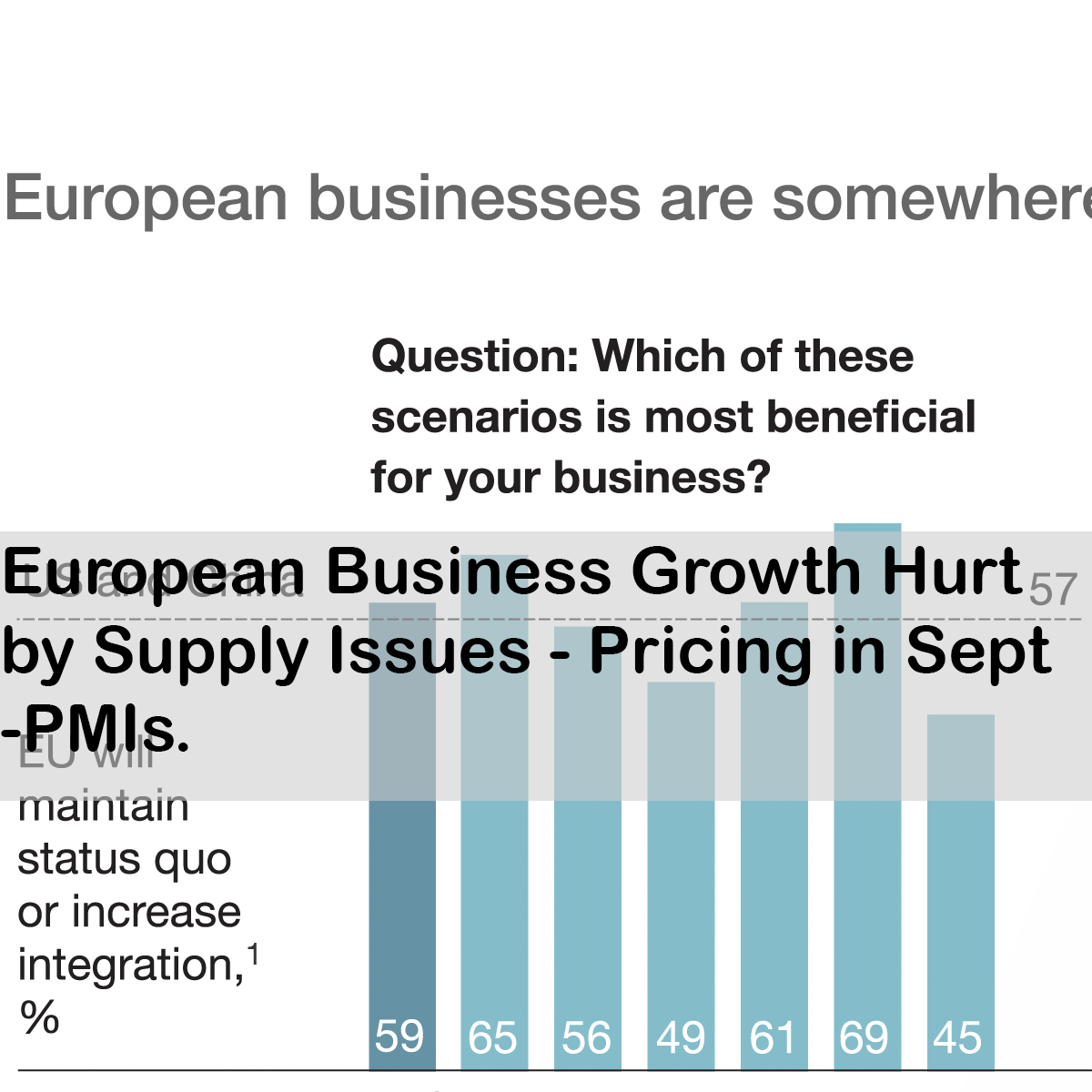

HIS Markit’s last composite Purchasing Managers’ Index (PMI), seen as a decent manual for monetary health, got down with 56.2 last month as from August’s with 59.0, but still well over the 50 imprints isolating development from constriction and simply over a 56.1 “streak” gauge.

A PMI for the administration’s area tumbled to 56.4 from 59.0, its least since May, while the new business list dropped to 55.3 from 57.9. On Friday, a eurozone developing PMI showed development stayed hearty in September, yet action experienced production network bottlenecks, and the alliance’s prevailing help to the industry additionally saw the speed of extension to be slow.

Maddalena Martini at Oxford Economics said that “The present information affirms the service area stays on the way of recuperation, yet the speed of extension mellowed. In spite of the power staying strong, inflationary tensions and supply-side disturbances burden the viewpoint. Looking forward, we see these disadvantage dangers to stay towards the end of 2021.”

Request tumbled to a five-month low as firms passed on a piece of rising information costs, which rose at a record pace, to buyers. The composite yield costs list rose to 59.1 from 58.3, not a long way from the study highs set in the late spring months.

Action in Germany’s servicing industry kept on filling firmly in September; however, the recovery from the pandemic lost energy as get-up to speed impacts melted away, and more organizations were influenced by supply bottlenecks.

In France, service development slipped as inflationary tensions and COVID-19 conventions affected organizations. Italian and Spanish administrations development additionally eased back.

In the meantime, in Britain, post-lockdown financial recovery tried not to lose further power over the last month; however, organizations expanded costs at the quickest speed on record, adding to indications of rising expansion.

The World Health Organization has warned rich countries for accumulating COVID-19 antibodies for sponsor lobbies for bigger populace gatherings while less fortunate nations are attempting to rollout even first portions. The numerous limitations forced to contain the Covid pandemic have now been lifted in the locale; firms are experiencing deficiencies of staff, crude materials, and transport.

Longer-term reenactments utilizing the creation work expect that the possible development rate in both the EU15 and the EU27 will fall. This decrease will be consistent: the potential development rate will decay from 2.4% yearly in 2004-2020 to a normal yearly pace of 1.7% in 2021-2030 and afterward down to 1.3% in 2031-2060.

Also Read: Mark Zuckerberg Loses $6 Billion in Hours – Facebook Plunges